All Categories

Featured

Table of Contents

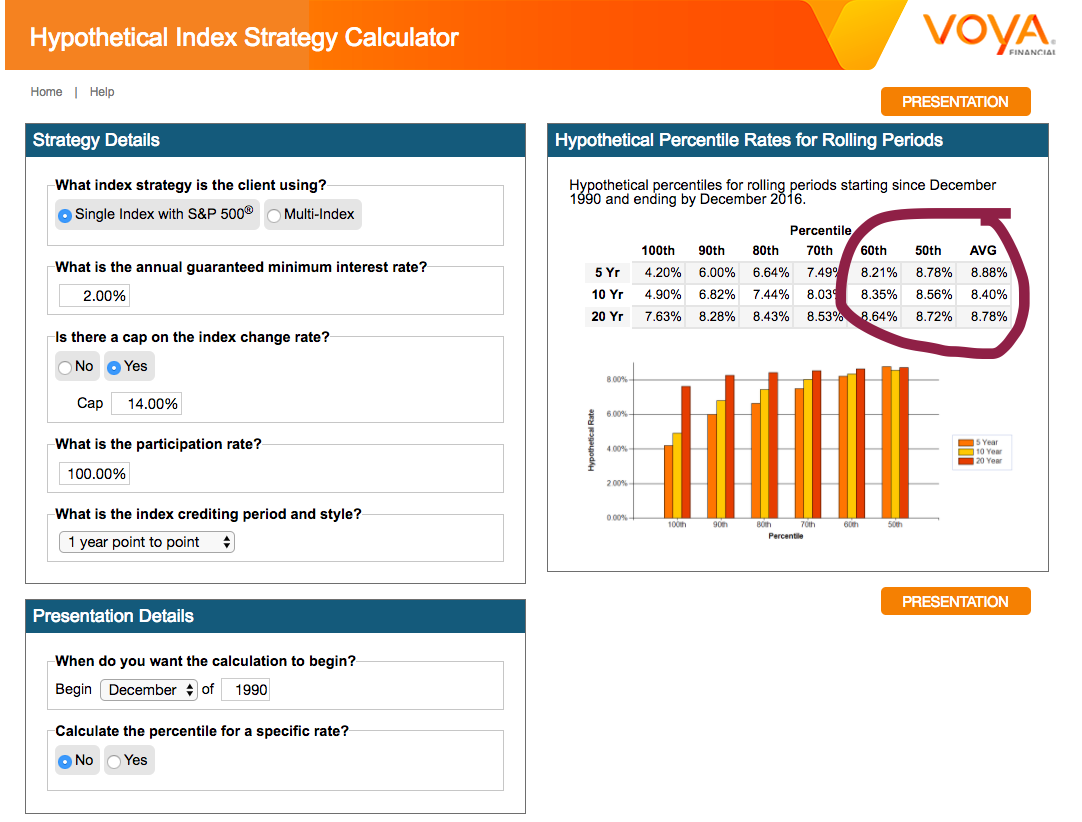

Various policies have different maximum degrees for the amount you can invest, as much as 100% (universal benefits corporation). A percent of the rate of interest income, which is called the involvement rate, is included to the money worth of the policy if the indexed account shows gains (usually calculated over a month). This is generally every year or once every five years.

This implies $200 is added to the cash worth (4% 50% $10,000 = $200). If the index drops in value or remains stable, the account internet little or nothing.

Having this suggests the existing cash worth is secured from losses in an improperly performing market., the client does not get involved in an unfavorable attributing rate," Niefeld stated. In other words, the account will certainly not shed its original cash value.

Group Universal Life Insurance Cash Value

As an example, a person that develops the plan over a time when the market is doing badly might finish up with high premium repayments that do not contribute in all to the cash money worth. The plan can then potentially lapse if the premium payments aren't made in a timely manner later in life, which could negate the point of life insurance altogether.

Insurance companies commonly establish maximum involvement rates of less than 100%. These limitations can restrict the real price of return that's attributed toward your account each year, no matter of exactly how well the policy's underlying index performs.

It's vital to consider your personal risk tolerance and financial investment objectives to ensure that either one aligns with your general approach. The insurance company makes money by keeping a section of the gains, consisting of anything above the cap. The attributing price cap may restrict gains in a bull market. If the capitalist's money is locked up in an insurance coverage, it can potentially underperform other financial investments.

The potential for a better rate of return is one benefit to IUL insurance policy plans contrasted to other life insurance coverage plans. Returns can in reality be reduced than returns on other items, depending on exactly how the market executes.

In the occasion of plan cancellation, gains come to be taxable as revenue. Fees are generally front-loaded and developed into complex crediting rate calculations, which might puzzle some financiers.

Sometimes, taking a partial withdrawal will also completely minimize the survivor benefit. Canceling or giving up a plan can result in even more prices. Because case, the cash surrender value might be much less than the advancing costs paid. Pros Supply higher returns than various other life insurance coverage policies Permits tax-free funding gains IUL does not minimize Social Safety and security advantages Plans can be designed around your threat hunger Cons Returns topped at a certain degree No ensured returns IUL might have higher charges than various other plans Unlike other types of life insurance policy, the value of an IUL insurance coverage is linked to an index linked to the stock exchange.

Guaranteed Universal Life Insurance Cost

There are lots of various other sorts of life insurance coverage plans, described below. Term life insurance provides a set advantage if the policyholder passes away within a set amount of time, normally 10 to three decades. This is one of the most economical kinds of life insurance coverage, as well as the most basic, though there's no money worth buildup.

The plan gets value according to a taken care of timetable, and there are fewer charges than an IUL insurance coverage plan. Variable life insurance coverage comes with also more versatility than IUL insurance, meaning that it is also extra complex.

Bear in mind, this kind of insurance stays undamaged throughout your whole life just like other irreversible life insurance plans.

Universal Life Policy Vs Term

Remember, however, that if there's anything you're uncertain of or you're on the fence about obtaining any kind of kind of insurance policy, be certain to speak with a specialist. By doing this you'll recognize if it's economical and whether it suits your economic plan. The cost of an indexed global life plan relies on numerous aspects.

You will certainly lose the fatality advantage named in the policy. On the other hand, an IUL comes with a fatality benefit and an extra money worth that the insurance holder can borrow against.

Indexed universal life insurance can assist you satisfy your family members's requirements for monetary protection while likewise developing cash money worth. However, these policies can be much more complex compared to various other sorts of life insurance policy, and they aren't necessarily ideal for every financier. Speaking to an experienced life insurance policy agent or broker can aid you choose if indexed global life insurance is a good fit for you.

Despite exactly how well you intend for the future, there are events in life, both anticipated and unexpected, that can influence the monetary wellness of you and your loved ones. That's a reason for life insurance. Survivor benefit is normally income-tax-free to beneficiaries. The death benefit that's normally income-tax-free to your beneficiaries can help guarantee your family members will have the ability to maintain their standard of life, aid them keep their home, or supplement shed earnings.

Points like potential tax obligation increases, inflation, monetary emergencies, and preparing for occasions like university, retired life, or also weddings. Some types of life insurance coverage can aid with these and various other concerns as well, such as indexed global life insurance, or merely IUL. With IUL, your policy can be a monetary resource, because it has the prospective to construct value with time.

An index might affect your passion attributed, you can not invest or straight participate in an index. Below, your policy tracks, but is not really spent in, an outside market index like the S&P 500 Index.

Who Should Buy Universal Life Insurance

Charges and costs may minimize policy worths. Because no solitary allotment will certainly be most efficient in all market settings, your economic professional can help you establish which mix may fit your financial objectives.

That leaves extra in your plan to possibly keep growing over time. Down the roadway, you can access any type of available cash money worth with plan car loans or withdrawals.

Speak with your financial expert about how an indexed global life insurance policy can be component of your overall economic technique. This web content is for basic instructional objectives just. It is not intended to offer fiduciary, tax obligation, or lawful suggestions and can not be utilized to avoid tax obligation fines; neither is it meant to market, promote, or suggest any kind of tax obligation plan or setup.

Life Insurance Cost Index

In the occasion of a lapse, impressive plan lendings in excess of unrecovered price basis will be subject to ordinary income tax. If a plan is a modified endowment contract (MEC), policy car loans and withdrawals will certainly be taxable as ordinary earnings to the extent there are profits in the policy.

Some indexes have multiple variations that can weight components or might track the effect of rewards in different ways. An index might impact your passion attributed, you can not buy, straight take part in or obtain reward payments from any of them through the plan Although an external market index might influence your passion credited, your plan does not directly take part in any supply or equity or bond financial investments.

This content does not use in the state of New york city. Warranties are backed by the financial stamina and claims-paying capability of Allianz Life Insurance Firm of North America. Products are provided by Allianz Life insurance policy Company of North America, 5701 Golden Hills Drive, Minneapolis, MN 55416-1297. .

Universal Life Insurance For Business Owners

The info and summaries consisted of right here are not intended to be complete summaries of all terms, problems and exclusions relevant to the products and solutions. The accurate insurance coverage under any kind of nation Investors insurance policy product goes through the terms, conditions and exemptions in the actual plans as provided. Products and solutions defined in this website differ from state to state and not all items, coverages or solutions are readily available in all states.

FOR FINANCIAL PROFESSIONALS We've designed to provide you with the ideal online experience. Your present browser might restrict that experience. You may be utilizing an old internet browser that's unsupported, or settings within your internet browser that are not suitable with our site. Please save yourself some frustration, and upgrade your web browser in order to watch our website.

Best Indexed Universal Life Policies

Currently utilizing an updated internet browser and still having difficulty? Please offer us a call at for more assistance. Your existing web browser: Finding ...

Latest Posts

Maximum Funded Indexed Universal Life

Index Assurance

How Much Does Universal Life Insurance Cost